Newcrest Mining agrees to reunite with gold giant Newmont

Newmont (NYSE: NGT; TSX: NEM) and Newcrest Mining (TSX: NCM; ASX: NCM) are getting back together after being separated for more than 30 years.

Newcrest, which started as an Australian subsidiary of gold giant Newmont in the 1960s before being spun out as a separate company in 1990, accepted an A$26.2 billion (US$17.5 billion) takeover offer on May 14. It has previously rejected two offers. The enterprise value of the offer is A$28.8 billion (US$19.3 billion), including net debt.

The merger will create a mega-miner with the industry’s largest reserve and resource base.

On a conference call discussing the deal, Newmont president and CEO Tom Palmer said the merger would help the miner succeed in a “dynamic, complex and unpredictable environment” generated by societal, technological and geopolitical “megatrends,” and consolidates a portfolio of Tier 1 gold and copper assets in lower-risk jurisdictions.

“The addition of the Newcrest assets to the Newmont portfolio allows us to consolidate two world-class gold and copper mining districts in Australia and in Canada… unlocking compelling strategic, operational and sustainability driven synergies, unique to this transaction.”

The agreement will see Newcrest shareholders receive 0.4 of a Newmont share for each share held, plus a special dividend of up to $1.10 per share. If shareholders and regulators approve the deal, Newmont shareholders will end up with 69% of the merged company and Newcrest shareholders 31%. The companies expect the merger to close in the year’s final quarter.

The new deal offers Newcrest a 30.4% premium over its $22.45 per share closing price on Feb. 3. Newmont first offered 0.363 shares for each Newcrest share, before raising the share-exchange ratio to 0.38 shares in February.

More than 50% of Newcrest shareholders will need to vote in favour of the merger, with at least 75% of votes cast in order for the merger to proceed. A simple majority of votes cast in favour by Newmont shareholders will also be required.

In a release, Palmer noted that leveraging the company’s learnings from its acquisition of Goldcorp four years ago, Newmont believes it can deliver an estimated $500 million in annual synergies and $2 billion in incremental cash flow from portfolio optimization opportunities.

“This transaction also increases Newmont’s annual copper production – a metal vital for the new energy economy – and adds nearly 50 billion pounds of copper reserves and resources from Newcrest to our robust and balanced portfolio. We intend to quickly realize these opportunities to create superior value for our shareholders, workforce, host communities and governments.”

Newcrest chairman Peter Tomsett said that the transaction will provide significant value to Newcrest shareholders “through the recognition of our outstanding growth pipeline.” He added: “In addition to the ongoing benefits of merging these premier portfolios, the combined group will set a new benchmark in gold production while benefitting from a material and growing exposure to copper and a market leading position in safety and sustainability.

Newcrest’s board has unanimously backed the proposal.

Brian MacArthur, a mining analyst with Raymond James says the deal gives Newmont the chance to acquire long-life assets and reserves and resources in lower-risk jurisdictions while increasing its copper exposure.

“The combined company would produce about 8 million oz. of annual gold production with more than 5 million gold oz. from 10 large, long-life, low cost, Tier 1 assets,” he wrote. “Combined annual copper production would be about 350 million lb. from Australia and Canada.”

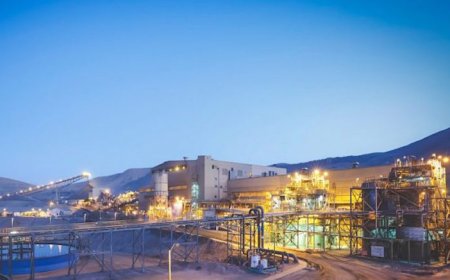

Newcrest’s operations include the Brucejack gold mine and 70% of the Red Chris copper-gold mine in British Columbia, Telfer gold-copper mine in Western Australia and Lihir gold mine in Papua New Guinea. It also holds a stake in the advanced Havieron gold-copper project in Western Australia and 50% of the advanced Wafi-Golpu gold-copper project in PNG in a 50-50 joint venture with Newmont.

Newmont has mines in Australia, Africa and across the Americas with about 96 million oz. of gold reserves. Newcrest counts gold reserves of about 52 million oz.

Newmont will retain its TSX listing after the deal closes. Its shares traded 1.5% higher in late morning. Newcrest shares also traded 1.2% higher at $25.84 apiece.