Mixed fortunes for the American indexes during Apr. 3-6 trading week

The Dow Jones Industrial Average gained 211.1 points or 0.6% to 33,485.29 and the S&P 500 fell 4.29 points or 0.1% over the week to 44,105.02.

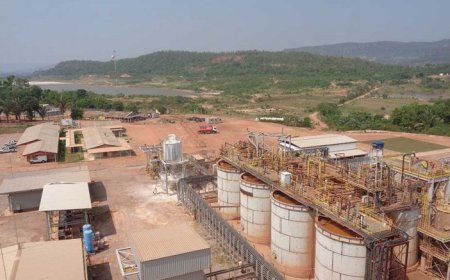

Franco-Nevada was the top value gainer this week, adding US$8.24 to close Thursday at US$154.04 per share. The company’s shares have been on the front foot since First Quantum Minerals announced a month ago it had signed a new draft contract with the Panama government regarding the restart of the idled Cobre Panama copper mine. The proposed agreement, which follows months of complex negotiations, meets the government’s goals outlined in January 2022 regarding government revenues, environmental protections, labour standards and legal protections for both sides. Cobre Panama is expected to be the largest growth driver through the period. First Quantum is looking to expand the mine from its current 85 million tonnes yearly throughput to 100 million tonnes per year by the end of 2023. Franco Nevada derived about 18% of its 2021 revenue from Cobre Panama. The company will report full-year results on May 2 after market close.

Among the top percentage gainers this week was the world’s third-biggest gold producer Agnico Eagle Mines which gained 10.9% to close at US$56.54. The gains capped off an eventful week for the company after consolidating its ownership in Canada’s largest openpit gold mine, Canadian Malartic, in Que., on Apr. 3, after buying out 50% partner Yamana Gold. The stock also benefited on Apr. 10, when Agnico and Teck Resources closed their previously announced joint venture to advance the San Nicolás copper-zinc project in Mexico. Under the agreement, Agnico Eagle, through a wholly-owned Mexican subsidiary, will take a 50% stake in Minas de San Nicolás for US$580 million. Teck and Agnico Eagle are now 50/50 JV partners at San Nicolás in Zacatecas state.

Barrick Gold counted among the top traded issuers on the NYSE this week. It saw 86.9 million shares change hands during the trading week to close at US$1.16, higher at US$19.73. Barrick made headlines on Apr. 4 when it announced an earn-in agreement on Midland Exploration’s Patris property in western Quebec. As part of the deal, Barrick will make cash payments of $1.02 million and undertake exploration work totalling $16.57 million over eight years, giving it up to a 75% stake in Patris. Midland said that the Toronto-based miner would be the operator of the work carried out under the agreement. The Patris gold property, 30 km northeast of Rouyn-Noranda, comprises 298 claims covering a surface area of about 117 sq. km, very close to the Doyon/Westwood-Bousquet-La Ronde gold mining camp.