Gold mining stocks retreat on signs Israel-Iran tensions ease

Gold mining stocks are suffering their worst trading session in two months as the price of bullion drops amid signs of easing geopolitical tensions between Israel and Iran.

The pullback in the precious metal follows a run of five weekly gains that set record highs along the way, providing a tailwind for mining stocks along the way, on rising demand for havens. That momentum hit a wall Monday after Iran downplayed recent strikes by Israel, saying the country received “the necessary response at this stage.”

The previous week’s 2% gain in gold prices quickly headed lower “after Iran downplayed the strikes as limited, signaling a potential de-escalation in the Israel-Iran conflict,” BofA Global Research noted in a report Monday.

The VanEck Gold Miners ETF fell as much as 4.8% on Monday to mark its biggest intraday drop since Feb. 13, snapping a three-day winning streak. Gold snapped a three-day winning, with prices falling as much as 2.6% to $2,329 an ounce Monday

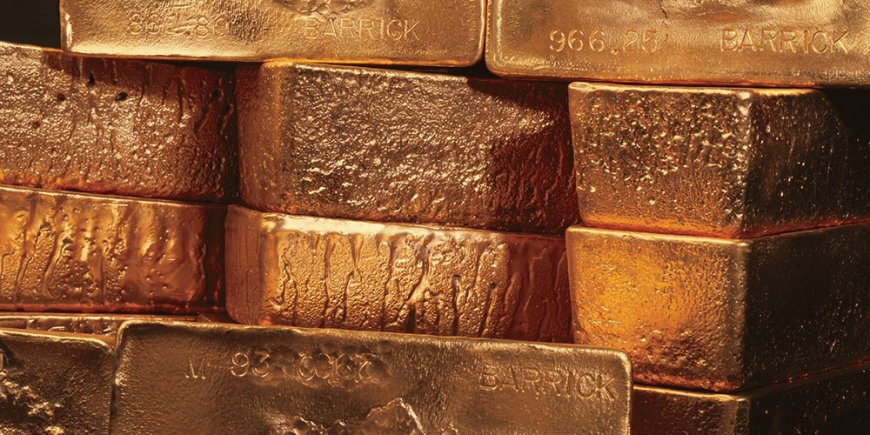

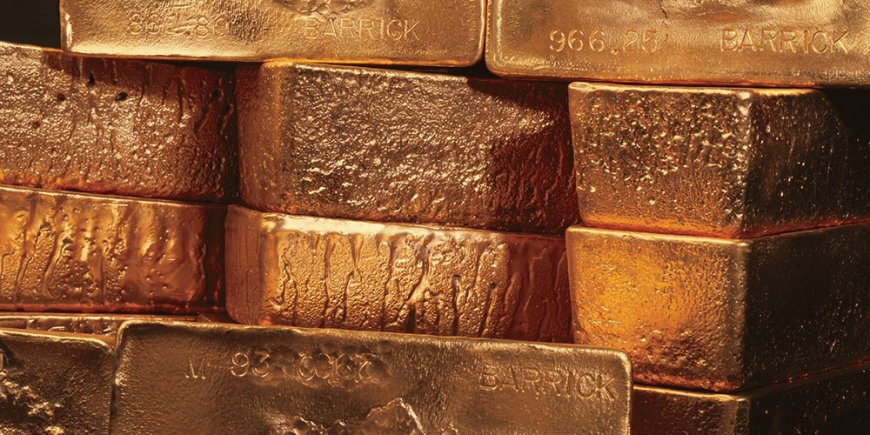

Newmont Corp. was among the biggest decliners in the S&P 500 Index on Monday, falling as much as 4.2%, to mark its biggest intraday decline since March 12. Peers falling included Barrick Gold Corp., which dropped 3.9%, and Agnico Eagle Mines Ltd., down 2.7%.