Gatos Silver surges on record silver output from Mexico mine

Gatos Silver (NYSE, TSX: GATO) shares rose by 12% Wednesday after the company saw its best ever quarter and calendar year for silver production at its Cerro Los Gatos (CLG) mine, comfortably beating its 2022 production guidance, Gatos said in a news release Tuesday.

For the year, the Mexico-focused silver miner posted a record 10.3 million oz. at its 70%-owned CLG mine, up 36% from the 7.6 million oz. produced in 2021, and 7% higher than the upper end of its most recent 2022 guidance range of 9.35-9.65 million ounces. The production guidance was raised in October from the initial range of 8.5-9.0 million ounces.

A key part of Gatos’ annual guidance beat was a record fourth quarter production of 2.9 million oz., up 26% from 2.3 million oz. from Q4 in 2021 and surpassing the previous record of 2.7 million oz. achieved in Q3 2022.

“Our excellent results reflect the quality of the CLG assets and the management team’s ability to improve operations and maximize cash flows,” Dale Andres, CEO of Gatos Silver, said in the release.

“Our focus in 2023 will be to further optimize operational performance, advance our mine life extension opportunities by converting the higher-grade portion of our current mineral resource into reserves and advancing definition drilling on the mineralization recently discovered at depth in the new South-East Deeps zone,” he added.

According to the company, the higher output from the fourth quarter and full year 2022 was primarily due to higher silver ore grades and mill throughput rates at CLG. Production sequencing in 2022 was from the highest-grade sections of the orebody, as considered in the 2022 life-of-mine plan.

Mill throughput averaged 2,847 tonnes per day during the fourth quarter of 2022, an increase of 9% compared to the fourth quarter of 2021. During 2022, the mill achieved a record 2,662 tonnes per day, which was 7% higher than in 2021.

With higher throughput rates, CLG’s production of other metals – zinc, lead and gold – also increased last year, with zinc and gold near the high end of guidance, and lead near the midpoint. Compared with 2021, zinc production increased by 22%, lead production by 10% and gold production by 2%.

Commenting on the production numbers in a research note on Wednesday, BMO Capital Markets’ Ryan Thompson said Gatos offers investors above-average leverage on silver.

“We see the potential for the company to deliver longer-term value to shareholders by exploring the company’s large 1,030-sq.-km land package. At current valuation, we think the risk-reward is balanced, underpinning our Market Perform rating,” he said.

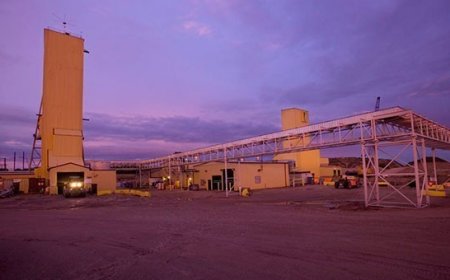

CLG is the first commercially producing mine and one of 14 mineralized zones identified by the company at its Los Gatos district property, located approximately 120 km south of Chihuahua City in Mexico.

Shares of Gatos Silver were up 12% by noon in Toronto on Wednesday, reaching $6.71 apiece and giving the company a market value of $464 million. Its shares have traded in a 52-week window of $3.06 and $14.55.