Australia’s Silver Lake ups bid for St Barbara’s Leonara by US$29M

Silver Lake Resources (ASX: SLR) isn’t giving up on St Barbara’s Leonara gold complex. The Perth-based company has submitted a third bid for the asset that increases the cash component by A$44 million (US$29 million) to match a rival offer from Genesis Minerals (ASX: GMD).

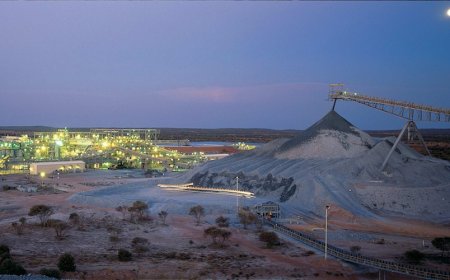

The company’s latest bid of A$722 million (about US$490 million) is expected to put more pressure on St Barbara’s board to entertain the suitor’s proposal for the Western Australia assets, consisting of the Gwalia gold mine and 1.4-million-tonne-per-year processing plant.

St Barbara has cited a lack of synergies as the reason for its repeated rejection of Silver Lake’s advances, adding a deal with the gold producer, as it stands, would not deliver sufficient cash to the company to meet its future liquidity requirements.

St Barbara reached an agreement with Genesis in April, which it says would allow it to focus on its struggling overseas mining interests.

Silver Lake’s latest offer represents a premium of 20.3% to Genesis’s A$600 million (US$400 million) proposal, which St. Barbara openly supports. It also matches the A$370 million in cash offered by Genesis.

L1 Capital Pty, which has a 9.34% stake in St Barbara, has requested a revision of Silver Lake’s revised proposal and has advised it would like to see the company engaging with Silver Lake to progress the “improved proposal” to binding offer stage, Silver Lake said in a statement.

“L1 Capital intends to vote its St Barbara shareholding against the Genesis Transaction at any meeting of shareholders convened to consider the transaction,” it noted.

Gold mining companies have been grabbing headlines this year over a flurry of merger and acquisition (M&A) activities. The biggest deals in the sector so far include the takeover of Newcrest, Australia’s largest gold producer by the world’s largest, Newmont. Agnico Eagle Mines and Pan American Silver outbidding Goldfields for Yamana Gold, and B2Gold’s buyout of Sabina Gold & Silver Corp.